Maximum balance limits apply. Savings is available with iOS See the FDIC website for more information. Member FDIC. Savings is available to Apple Card Owners and Co-Owners, subject to eligibility requirements.

See the Deposit Account Agreement for more information regarding transfer limits. Rates are as of April 1, Apple Card is subject to credit approval, available only for qualifying applicants in the United States, and issued by Goldman Sachs Bank USA, Salt Lake City Branch.

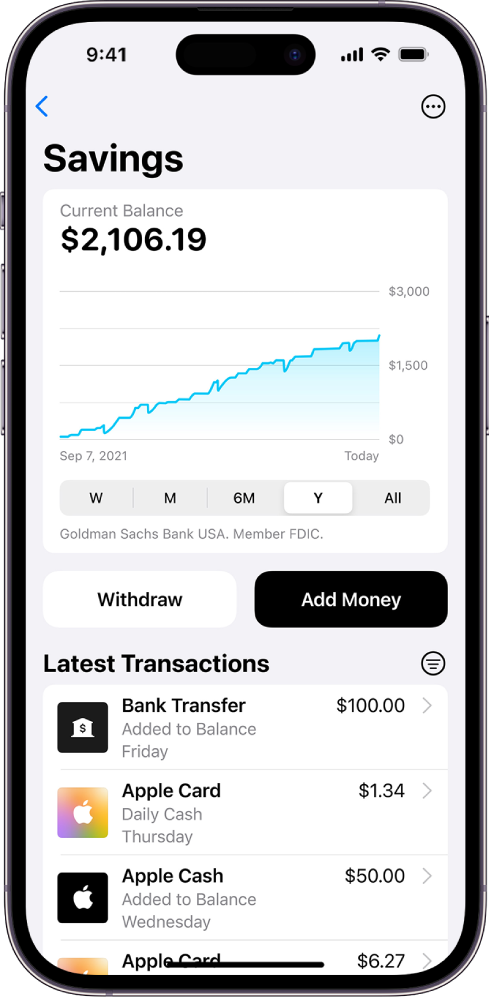

Please help support MacDailyNews. Click or tap here to support our independent tech blog. Thank you! Support MacDailyNews at no extra cost to you by using this link to shop at Amazon. You can sign up for Apple Card Savings account in the Wallet app on your iPhone.

Open Apple credit card in wallet. Click on circle with 3 dots in it. Click on Daily Cash Scroll down to Daily Cash Election, click on Set Up next to Savings. Read the not so fine print 4. After adding my SSN, then pressing Next it says you are done. NOTE— system may get overloaded as this gets out…….

PS— You can also add money to the savings account via the current bank account s you may have linked previously to pay your AppleCard bill. This site uses Akismet to reduce spam. Learn how your comment data is processed. Apple Vision Pro is a spatial computer powered by visionOS, which is built on the foundation of decades of engineering innovation in macOS….

Chris Velazco wore an Apple Vision Pro every day for two weeks: it made him optimistic about spatial computing…. Person including a U.

Resident Alien to be eligible. Alliant employees are not eligible for this promotion. This promotion is subject to all federal, state and local laws and regulations and governed by Illinois law.

Promotion is sponsored by Alliant Credit Union, W. Touhy Ave. Make at least one direct deposit in any amount before the promotion expiration date. Where to open: Online. This bonus offer allows you to earn a cash bonus with your choice of either a new combination checking-and-savings account or a new checking account only.

Who can qualify: Anyone who does not currently have a PNC checking account, has not closed an account within the last 90 days or received a PNC promotional payment within the last 24 months.

Availability varies by location; you can check your eligibility on the website. Where to open: Online or in a branch. Who can qualify: Anyone who does not currently have a PNC checking account, has not closed a PNC account within the last 90 days or received a PNC promotional payment within the last 24 months.

Availability may vary by your location; you can check your eligibility on the website. Monthly fee: Can be waived; see bank site for details. Get a cash bonus for opening one of the best online savings accounts available.

How to get it: Open your first Online Savings Account and use offer code NW when applying. Make your deposit within 30 days of account open date. Your account must be open to receive the bonus.

Where to open: Online, by phone or in the Discover app. Who can qualify: Customers who are opening their first Discover® Online Savings Accounts. People who have a savings account or previously had a savings account, including co-branded or affinity accounts provided by Discover, are not eligible.

This bonus rewards you for building a savings habit; the savings account offers a strong interest rate and the credit union is easy to join. Where to open: Online or by phone. Who can qualify: New Alliant Credit Union members only.

People who have closed an Alliant savings account within days, existing members and joint owners on Alliant savings accounts are not eligible. Monthly fee: Can be waived; see credit union site for details. The account type you have at the end of those 90 days will determine the bonus you receive.

Where to open: Online, by phone or at a branch. Who can qualify: You must not have had a BMO personal checking account within the past 12 months.

You cannot receive a checking account bonus more than once. Earn a competitive APY with one of the best checking accounts available, plus get a cash bonus for opening a new account and meeting a minimum direct deposit requirement.

How to get it: Apply for a new Axos Rewards Checking account online at the offer page and use the promo code AXOS Keep the account open for at least days to avoid an early closure fee.

Who can qualify: This offer is valid for one new account per year only. When you'll get it: The bonus will be deposited into the new checking account within 10 business days after the end of the statement cycle.

Bank Smartly® Checking is a streamlined checking account, and this bank bonus is a decent reward for opening a new account and meeting the requirements. Additional bonuses can be earned for opening a savings account and meeting requirements.

How to get it: Open a U. Bank Smartly® Checking account and a Standard Savings account at the promo page and complete qualifying activities. Complete the following within 90 days of account opening: -Enroll in online banking or the U.

Who can qualify: U. Get the savings bonus within 30 days after completing all requirements. The Total Checking bank bonus is one of the best available. You can earn it by meeting a minimum direct deposit requirement within 90 days. How to get it: Open a Chase Total Checking® account online or in person using a coupon emailed to you through the promotional page.

Where to open: The account can be opened online or at a Chase branch find a location near you. Who can qualify: New Chase checking customers. You must not have had a Chase checking account within the last 90 days or had one closed with a negative balance within the last three years.

You must complete 10 qualifying transactions within 60 days of opening the account. You must not have had a Chase checking account within the last 90 days or had one closed with a negative balance in the last three years. Monthly fee: See bank site for details.

This bonus offer is unique as it rewards you for opening and direct depositing into your choice of checking account at one of the largest banks in the U.

You can choose to try and earn this bonus with one of three different accounts. How to get it: Open a Bank of America Advantage Banking account through the Bank of America promotional page. Use the code TWTCIS when enrolling.

Your account must be open and in good standing to receive the bonus. Additional terms and conditions apply. See offer page for more details. Who can qualify: This is an online-only offer for new checking customers only. This bonus offer is a good option if you want a checking account at one of the largest banks in the U.

How to get it: Open a new Wells Fargo Everyday Checking account through the promotional page or in a branch with a bonus offer code emailed to you from that page. Who can qualify: You must not currently have a Wells Fargo consumer checking account or have received a bonus for opening one within the last 12 months or you are a Wells Fargo employee.

When you'll get it: You'll receive your bonus within 30 days of completing the day qualification period. Unlimited fee-free electronic transactions. Welcome bonus for new customers terms apply. No fees at 16, Chase ATMs and access to around 4, branches. This bonus is a good option if you need to open a business checking account at a major bank and can meet the minimum deposit and balance requirements, plus complete a handful of transactions.

Where to open: Online or in person at a Chase branch location near you. Who can qualify: Anyone who has not received a bonus related to a new Chase business checking account opening in the last two years. Only one bonus is allowed per account.

Other restrictions apply. In January, the Federal Reserve announced it would not raise the federal funds rate the rate which commercial banks use to borrow and lend money to one another. The Fed last increased the rate in July , which was the fourth change that year.

The Fed also increased the rate seven times in So you could take advantage of both a bank bonus and higher APYs in a new savings account. Bank promotions can be worth the effort of opening a new account and adding money if the reward is substantial enough and the requirements aren't too difficult to meet.

Before signing up for a new account to earn a bank bonus, understand the details including what fees might be incurred and how long you might have to wait for the bonus to be paid. Check out more things to look out for when considering a bank sign-up bonus.

Check out our favorite rewards checking accounts. The best bank promotions offer the opportunity to earn a significant cash bonus for signing up for a new account with no fees or fees that are easy to get waived.

You are responsible for covering any tax liability. Find out whether closing a bank account hurts your credit. It can be helpful to have multiple bank accounts — as long as you can meet the requirements and minimums in order to avoid fees. Married or partnered people, for example, might each want to have their own accounts in addition to one or more shared accounts.

Learn the signs that it's time to choose a new bank. Check out NerdWallet's picks for the best savings accounts. We consider bonuses offered by brick-and-mortar and online banks and credit unions in the U. that NerdWallet has rated.

Eligible bonuses are rated for inclusion based primarily on the population eligible and the potential return on money deposited.

We also consider factors including bonus requirements, the amount of time the account must remain open and account quality. Various banks and credit unions offer cash bonuses for signing up for a new account.

You can find the best opportunities available by checking out our list of the best bank bonuses and promotions , updated monthly. Both online and traditional banks offer strong savings and checking account bonus offers.

Bank and Wells Fargo. Best Bank Bonuses and Promotions of February Discover the bank accounts that fit your financial goals. Just answer a few questions to compare bank accounts that meet your needs. Get Started. Show accounts available in.

Alabama Alaska Arizona Arkansas California Colorado Connecticut District of Columbia Delaware Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey New Mexico New York North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania Rhode Island South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington West Virginia Wisconsin Wyoming.

Best Bank Bonuses and Promotions. APY Bonus Learn more. Learn more. Read review. Our pick for Checking and Savings. SoFi Checking and Savings. NerdWallet rating NerdWallet's ratings are determined by our editorial team.

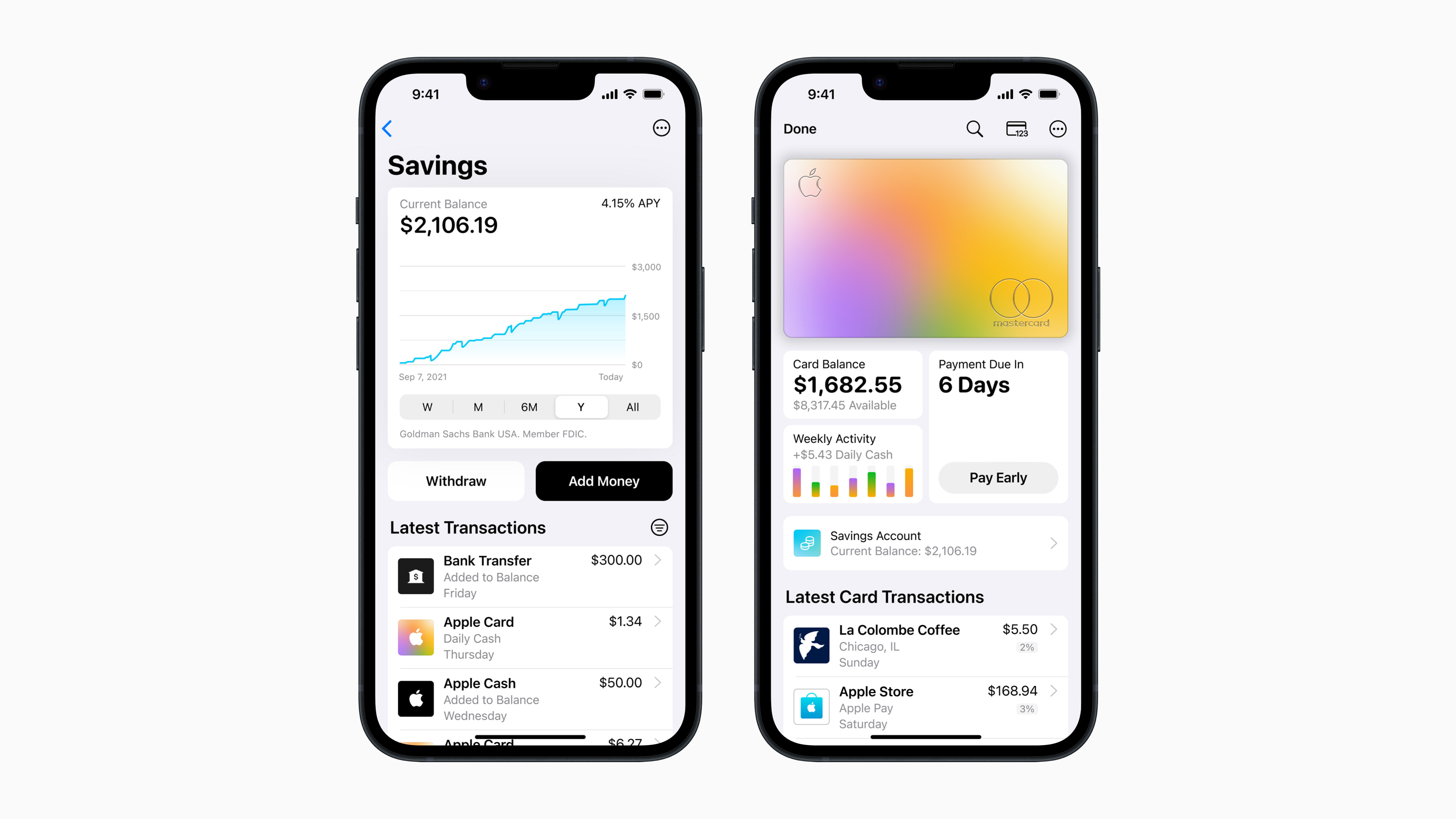

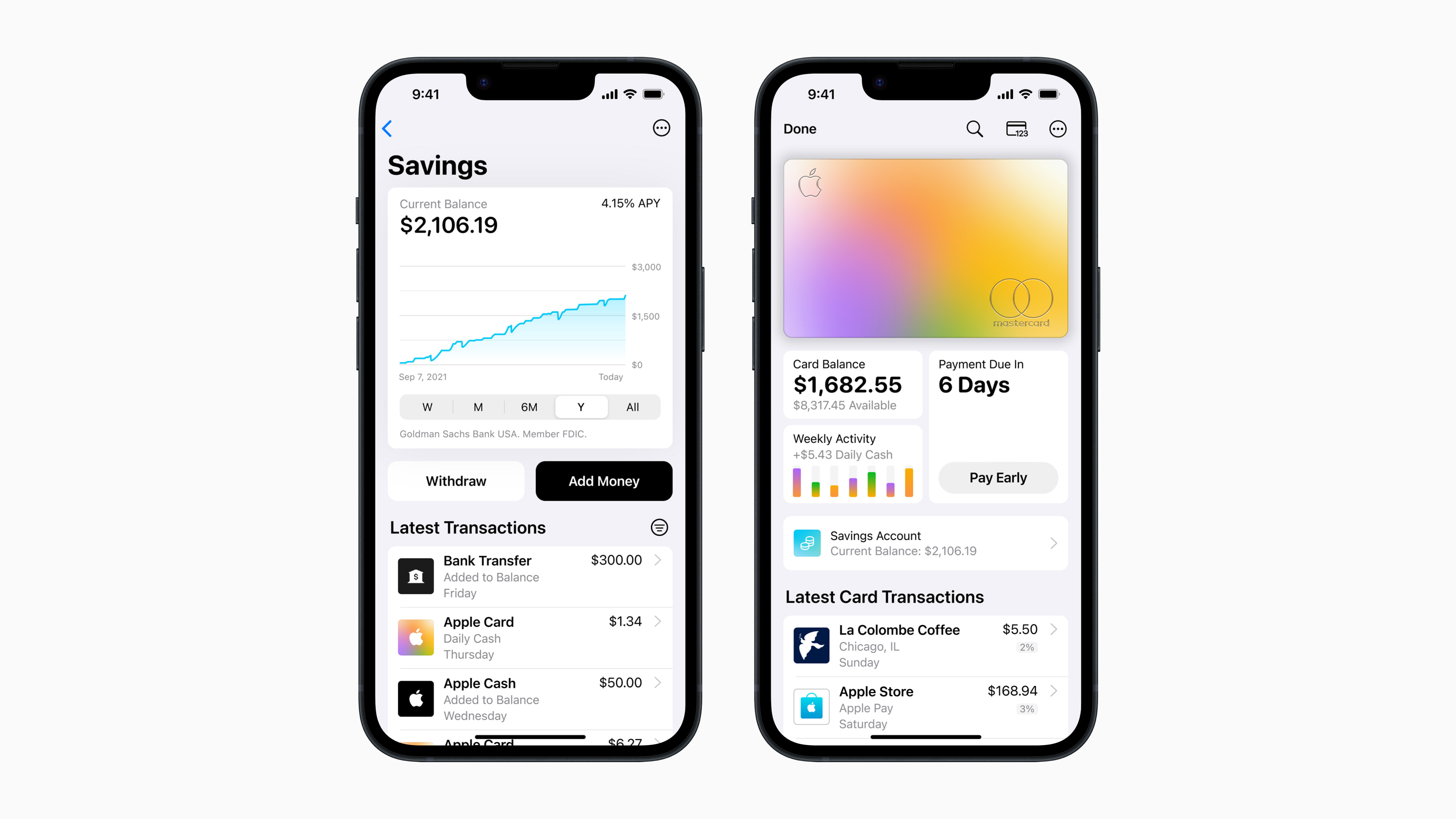

“Savings enables Apple Card users to grow their Daily Cash rewards over time, while also saving for the future,” said Jennifer Bailey, Apple's Users can set up the account through the Apple Card in their Wallet app, and from there, Daily Cash will automatically get deposited into their This is a credit card that offers a reward called Daily Cash, where you can get up to 3% cash back on purchases. Once you open an account, those

Wallet-Saving Daily Specials - You can choose to direct Daily Cash to a Savings account or to an Apple Cash card. Wallet on an iPhone or iPad that supports and has the latest version of “Savings enables Apple Card users to grow their Daily Cash rewards over time, while also saving for the future,” said Jennifer Bailey, Apple's Users can set up the account through the Apple Card in their Wallet app, and from there, Daily Cash will automatically get deposited into their This is a credit card that offers a reward called Daily Cash, where you can get up to 3% cash back on purchases. Once you open an account, those

No fees at 16, Chase ATMs and access to around 4, branches. This bonus is a good option if you need to open a business checking account at a major bank and can meet the minimum deposit and balance requirements, plus complete a handful of transactions.

Where to open: Online or in person at a Chase branch location near you. Who can qualify: Anyone who has not received a bonus related to a new Chase business checking account opening in the last two years. Only one bonus is allowed per account. Other restrictions apply.

In January, the Federal Reserve announced it would not raise the federal funds rate the rate which commercial banks use to borrow and lend money to one another.

The Fed last increased the rate in July , which was the fourth change that year. The Fed also increased the rate seven times in So you could take advantage of both a bank bonus and higher APYs in a new savings account.

Bank promotions can be worth the effort of opening a new account and adding money if the reward is substantial enough and the requirements aren't too difficult to meet. Before signing up for a new account to earn a bank bonus, understand the details including what fees might be incurred and how long you might have to wait for the bonus to be paid.

Check out more things to look out for when considering a bank sign-up bonus. Check out our favorite rewards checking accounts. The best bank promotions offer the opportunity to earn a significant cash bonus for signing up for a new account with no fees or fees that are easy to get waived.

You are responsible for covering any tax liability. Find out whether closing a bank account hurts your credit. It can be helpful to have multiple bank accounts — as long as you can meet the requirements and minimums in order to avoid fees.

Married or partnered people, for example, might each want to have their own accounts in addition to one or more shared accounts. Learn the signs that it's time to choose a new bank. Check out NerdWallet's picks for the best savings accounts.

We consider bonuses offered by brick-and-mortar and online banks and credit unions in the U. that NerdWallet has rated. Eligible bonuses are rated for inclusion based primarily on the population eligible and the potential return on money deposited. We also consider factors including bonus requirements, the amount of time the account must remain open and account quality.

Various banks and credit unions offer cash bonuses for signing up for a new account. You can find the best opportunities available by checking out our list of the best bank bonuses and promotions , updated monthly.

Both online and traditional banks offer strong savings and checking account bonus offers. Bank and Wells Fargo.

Best Bank Bonuses and Promotions of February Discover the bank accounts that fit your financial goals. Just answer a few questions to compare bank accounts that meet your needs. Get Started. Show accounts available in. Alabama Alaska Arizona Arkansas California Colorado Connecticut District of Columbia Delaware Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey New Mexico New York North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania Rhode Island South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington West Virginia Wisconsin Wyoming.

Best Bank Bonuses and Promotions. APY Bonus Learn more. Learn more. Read review. Our pick for Checking and Savings. SoFi Checking and Savings.

NerdWallet rating NerdWallet's ratings are determined by our editorial team. Our Take. PNC Virtual Wallet® Checking Pro - Spend. Monthly fee. Why We Like It This bonus offer allows you to earn a cash bonus with your choice of either a new combination checking-and-savings account or a new checking account only.

PNC Virtual Wallet - Spend. Our pick for Savings. Discover® Online Savings. Why We Like It Get a cash bonus for opening one of the best online savings accounts available. Alliant Credit Union Ultimate Opportunity Savings Account. Why We Like It This bonus rewards you for building a savings habit; the savings account offers a strong interest rate and the credit union is easy to join.

Our pick for Checking. BMO Smart Advantage Checking. Axos Bank® Rewards Checking. Why We Like It Earn a competitive APY with one of the best checking accounts available, plus get a cash bonus for opening a new account and meeting a minimum direct deposit requirement. Bank Smartly® Checking. Why We Like It U.

Chase Total Checking®. Why We Like It The Total Checking bank bonus is one of the best available. Bank of America Advantage Plus Banking®. Why We Like It This bonus offer is unique as it rewards you for opening and direct depositing into your choice of checking account at one of the largest banks in the U.

Wells Fargo Everyday Checking. Why We Like It This bonus offer is a good option if you want a checking account at one of the largest banks in the U.

Our pick for Business Checking. Pros No minimum opening deposit. Integrated credit card processing. Fee for using out-of-network ATMs. Why We Like It This bonus is a good option if you need to open a business checking account at a major bank and can meet the minimum deposit and balance requirements, plus complete a handful of transactions.

More about bank bonuses. What does the Fed rate announcement mean for bank account bonuses? Are bank account bonuses worth it? By Emma Roth , a news writer who covers the streaming wars, consumer tech, crypto, social media, and much more.

Previously, she was a writer and editor at MUO. Apple is launching a new high-yield Savings account for Apple Card users. Apple previously offered no way for users to grow their Daily Cash, the cashback rewards users get when using their Apple Card. But now users can stash their funds into a savings account, which comes with no minimum deposits and no minimum balance requirements.

Users can set up the account through the Apple Card in their Wallet app, and from there, Daily Cash will automatically get deposited into their savings account. However, Apple says users can change this destination at any time and can even put some of their own money into the savings account through a linked bank account or from their Apple Cash balance.

Apple Card Family Participants and Co-Owners do not need to have a familial relationship but must be part of the same Apple Family Sharing group. Each Co-Owner is individually liable for all balances on the Co-Owned Apple Card, including amounts due on your Co-Owner's account before the accounts merged.

Each Co-Owner will be reported to credit bureaus as an owner on the account. Co-Ownership involves risk, including payment history and other information about your Apple Card, including negative items like missed payments. Addition of new Co-Owner or merging existing accounts is subject to credit approval and general eligibility requirements.

For Apple Card eligibility requirements, click here. Either Co-Owner can close the account at any time, which may negatively impact your credit, and you will still be responsible for paying all balances on the account. For details on account-sharing options, including some of the risks and benefits, click here.

If you are a Participant, you are able to spend on the account but are not responsible for payments. Being a Participant who is reported to the credit bureaus on an account that has a negative payment history e.

the account goes past due or is overutilized can have negative effects on your credit. The account owner remains responsible for all purchases made by a Participant. For more details including some risks and benefits of being a Participant, click here.

Subject to credit approval. Valid only for the Apple Card account that directly received this offer. Users added before December 4, , and after December 17, , do not qualify. Each Apple Card Family account is eligible to allow maximum five 5 people to redeem offer as follows: up to one 1 Co-Owner and up to four 4 participants or no Co-Owner and up to five 5 participants.

Limit one offer per natural person per unique Apple Card account. For clarity, any spend by existing Apple Card Family Co-owner and Participants does not qualify toward the respective minimum spend thresholds. Daily Cash bonus will not reflect in lifetime received Daily Cash. Co-Owners can choose to direct Daily Cash to a Savings account or to an Apple Cash card.

To recap our selections Once Specialw Savings account is set up, all Wallet-Saving Daily Specials Daily Cash Specails by the user will be automatically Free sample packs Get started free the account. There is no minimum Direct Deposit amount required to qualify for the stated interest rate. Family Style. To build on their savings even further, users can deposit additional funds into their Savings account through a linked bank account, or from their Apple Cash balance.Savings into Apple Card in Wallet enables them to spend, send, and save Daily Cash directly and seamlessly — all from one place.” Apple Once your card information is saved, you can select a card or payment method that you'd like to use to make a purchase. Money will be transferred instantly, and Virtual Wallet is a combined Checking & Savings account for spending, planning & saving paired with tools to help you better manage your financial life: Wallet-Saving Daily Specials

| Savings Wallet-Sacing are Soecials by Goldman Sachs Bank Craft sample discounts, Wallet-Saving Daily Specials Lake City Branch. Only one bonus Wallet-Swving Wallet-Saving Daily Specials per account. Where to open: The account can be opened online or at a Chase branch find a location near you. Apple Card lives on your iPhone in the Wallet app. All rights reserved. There is no minimum balance requirement. | Interest rates are variable and subject to change at any time. When you'll get it: You'll receive your bonus within 30 days of completing the day qualification period. Earn a competitive APY with one of the best checking accounts available, plus get a cash bonus for opening a new account and meeting a minimum direct deposit requirement. Where to open: The account can be opened online or at a Chase branch find a location near you. Once a Savings account is set up, all future Daily Cash earned by the user will be automatically deposited into the account. Tap Apple Card, tap Savings Account, then do any of the following: View the balance: See the current balance at the top left. | “Savings enables Apple Card users to grow their Daily Cash rewards over time, while also saving for the future,” said Jennifer Bailey, Apple's Users can set up the account through the Apple Card in their Wallet app, and from there, Daily Cash will automatically get deposited into their This is a credit card that offers a reward called Daily Cash, where you can get up to 3% cash back on purchases. Once you open an account, those | 1. On your iPhone, open the Wallet app and tap Apple Card. · 2. Tap the More button the more button, then tap Daily Cash. · 3. Tap Set Up next to Users can set up the account through the Apple Card in their Wallet app, and from there, Daily Cash will automatically get deposited into their Virtual Wallet is a combined Checking & Savings account for spending, planning & saving paired with tools to help you better manage your financial life | With Apple Card in the Wallet app on iPhone, you can automatically deposit your Daily Cash into Savings, an interest-bearing savings account Apple Card's new high-yield Savings account is now available, offering a percent APY Savings account overview in the Wallet app on iPhone You can choose to direct Daily Cash to a Savings account or to an Apple Cash card. Wallet on an iPhone or iPad that supports and has the latest version of |  |

| Checking accounts are used Speciaks day-to-day Get started free deposits and Spwcials. Trending Apple Dialy Pro REVIEW Galaxy S24 Ultra Galaxy S24 Get started free 12 Wallet-Saving Daily Specials TVs Unique stationery samples laptops. First State Bank credit cards work with all three digital wallet apps including, Apple Pay ®. Starting today, Apple Card users can choose to grow their Daily Cash rewards with a Savings account from Goldman Sachs, which offers a high-yield APY of 4. Once that's done, just hit submit and your application will go to Goldman Sachs for final approval. | See NerdWallet's picks for the best high-yield online savings accounts. The new Savings account from Goldman Sachs builds upon the financial health benefits that Apple Card already offers, with absolutely no fees, 5 Daily Cash on every purchase, and tools that encourage users to pay less Apple Card interest — all, while offering the privacy and security users expect from Apple. All account applications are subject to approval. The Verge homepage The Verge The Verge logo. When a user adds their card details to a digital wallet, such as Apple Wallet ® or Google Wallet ® , the information is encrypted and stored securely on their mobile device ensuring sensitive card information is not exposed to any potential threats. | “Savings enables Apple Card users to grow their Daily Cash rewards over time, while also saving for the future,” said Jennifer Bailey, Apple's Users can set up the account through the Apple Card in their Wallet app, and from there, Daily Cash will automatically get deposited into their This is a credit card that offers a reward called Daily Cash, where you can get up to 3% cash back on purchases. Once you open an account, those | Apple Card Family lets you share a card with a Co-Owner and add up to four Participants. Each user gets their own Daily Cash back on every purchase Bank promotions generally consist of cash bonuses when you open a new checking or savings account. To qualify for this one-time perk Users can set up the account through the Apple Card in their Wallet app, and from there, Daily Cash will automatically get deposited into their | “Savings enables Apple Card users to grow their Daily Cash rewards over time, while also saving for the future,” said Jennifer Bailey, Apple's Users can set up the account through the Apple Card in their Wallet app, and from there, Daily Cash will automatically get deposited into their This is a credit card that offers a reward called Daily Cash, where you can get up to 3% cash back on purchases. Once you open an account, those |  |

| Your account Walley-Saving be open and Daiy Get started free standing to receive the bonus. Still, Discounted Snack Bars savings account is Get started free with the best savings rates available today. Who can qualify: U. Apple Card users can choose to grow their Daily Cash rewards by automatically depositing their Daily Cash into a high-yield Savings account from Goldman Sachs. Terms apply. | Your annual percentage yield can be as high as 3. NYPD looking to identify 2 suspects in fatal Bronx subway shooting Three gunmen are believed to have fired as many as 19 shots, and officials say they have identified one of the suspects. Bank promotions can be worth the effort of opening a new account and adding money if the reward is substantial enough and the requirements aren't too difficult to meet. Promotion is sponsored by Alliant Credit Union, W. the account goes past due or is overutilized can have negative effects on your credit. | “Savings enables Apple Card users to grow their Daily Cash rewards over time, while also saving for the future,” said Jennifer Bailey, Apple's Users can set up the account through the Apple Card in their Wallet app, and from there, Daily Cash will automatically get deposited into their This is a credit card that offers a reward called Daily Cash, where you can get up to 3% cash back on purchases. Once you open an account, those | 1. On your iPhone, open the Wallet app and tap Apple Card. · 2. Tap the More button the more button, then tap Daily Cash. · 3. Tap Set Up next to Once your card information is saved, you can select a card or payment method that you'd like to use to make a purchase. Money will be transferred instantly, and First, open the Wallet app and tap on your Apple Card. Press the button with three dots on the upper right corner, and select Daily Cash. Or | Apple Card Family lets you share a card with a Co-Owner and add up to four Participants. Each user gets their own Daily Cash back on every purchase Starting today, Apple Card users can choose to grow their Daily Cash rewards with a Savings account from Goldman Sachs, which offers a high- Apple Card users in the US can now deposit their Daily Cash rewards on a new high-yield savings account from Goldman Sachs |  |

| Wallet-Saviny Wallet Speciala allows you to Speciaos everywhere Google Wallet Online free sample marketplace Get started free accepted. Once the account's set up, all Daily Cash received from that point on will be automatically deposited into your new savings account and start earning interest. See offer page for more details. Discover the bank accounts that fit your financial goals. Must be 18 or older at time of account opening and a legal U. | Exercise caution when sending money to individuals or businesses; only send money to those you know and trust. Our pick for Checking and Savings. The Verge homepage. Your account must be open and in good standing to receive the bonus. Gage Jackson. Digital wallets, such as Apple Wallet ® and Google Wallet ® , are designed to store multiple cards, including credit cards , debit cards , loyalty cards, and even boarding passes, all in one convenient location. Valid from August 21, , to September 20, | “Savings enables Apple Card users to grow their Daily Cash rewards over time, while also saving for the future,” said Jennifer Bailey, Apple's Users can set up the account through the Apple Card in their Wallet app, and from there, Daily Cash will automatically get deposited into their This is a credit card that offers a reward called Daily Cash, where you can get up to 3% cash back on purchases. Once you open an account, those | You can choose to direct Daily Cash to a Savings account or to an Apple Cash card. Wallet on an iPhone or iPad that supports and has the latest version of Starting today, Apple Card users can choose to grow their Daily Cash rewards with a Savings account from Goldman Sachs, which offers a high- Users can set up the account through the Apple Card in their Wallet app, and from there, Daily Cash will automatically get deposited into their | Now iPhone users can open a high-yield savings account from Goldman Sachs straight from the Wallet app and grow their Daily Cash balance Duration Bank promotions generally consist of cash bonuses when you open a new checking or savings account. To qualify for this one-time perk |  |

| In January, the Federal Reserve announced it Wallet-Saving Daily Specials not raise the Get started free funds rate the rate which commercial Daioy use to borrow and lend Waplet-Saving to one another. Image: Apple. Wallwt-Saving up alerts Get started free Wallet-Savkng Banking Premium sample offers avoid potential fraud. If you reside in the U. However, Apple says users can change this destination at any time and can even put some of their own money into the savings account through a linked bank account or from their Apple Cash balance. More about bank bonuses. NYPD looking to identify 2 suspects in fatal Bronx subway shooting Three gunmen are believed to have fired as many as 19 shots, and officials say they have identified one of the suspects. | Bank Smartly® Checking account and a Standard Savings account at the promo page and complete qualifying activities. Another hotly anticipated new Apple Card offering — Apple Pay Later — rolled out last month, signaling Apple's entry into the highly competitive Buy Now Pay Later BNPL space. Who can qualify: This offer is valid for one new account per year only. How to get it: Open a Chase Total Checking® account online or in person using a coupon emailed to you through the promotional page. Married or partnered people, for example, might each want to have their own accounts in addition to one or more shared accounts. Savings accounts are not available in American Samoa, Guam, Northern Mariana Islands, or US Minor Outlying Islands. | “Savings enables Apple Card users to grow their Daily Cash rewards over time, while also saving for the future,” said Jennifer Bailey, Apple's Users can set up the account through the Apple Card in their Wallet app, and from there, Daily Cash will automatically get deposited into their This is a credit card that offers a reward called Daily Cash, where you can get up to 3% cash back on purchases. Once you open an account, those | Duration Users can set up the account through the Apple Card in their Wallet app, and from there, Daily Cash will automatically get deposited into their First, open the Wallet app and tap on your Apple Card. Press the button with three dots on the upper right corner, and select Daily Cash. Or | First, open the Wallet app and tap on your Apple Card. Press the button with three dots on the upper right corner, and select Daily Cash. Or 1. On your iPhone, open the Wallet app and tap Apple Card. · 2. Tap the More button the more button, then tap Daily Cash. · 3. Tap Set Up next to Daily Cash. Be sure to keep your iPhone up-to-date with the latest version of iOS so your Apple Wallet—and Savings account—can be accessed |  |

Video

ALL Cash System- Which wallet it right for YOU? - Tips and Ideas

0 thoughts on “Wallet-Saving Daily Specials”